-

1 基本概念

-

2 PPT

Chapter 9 Determinants of the Balance of Trade

ⅠExplaining the Balance of Trade with Theories

The balance of trade records a country’strade in goods and services with the rest of the world.

Why do some countries run a balance of tradesurplus, while others run deficits?

We try to explain this question using 2approaches.

-Elasticity Approach

-Absorption Approach

A. Trade and foreign exchange

When a country imports, it supplies foreignexchange as payment.

When a country exports, it demands foreignexchange as payment.

An excess supply of foreign exchange isequivalent to a balance of trade deficit.

An excess demand for foreign exchange isequivalent to a balance of trade surplus.

The balance of trade is in balance when thequantity of foreign exchange supplied and quantity demanded are equal.

B. Using the trade flow model to explain the devaluation

An increase in the demand for U.S. goods by the British.

The more they import, the more they supply the British pound.

Assume that the U.K. taste for U.S. goods rises.

The pound should depreciate.

The Bank of England can peg the exchange rateat $2.00/pound by selling $ and buying pound by the amount QS£- Q1£.

U.K. balance of trade:

Exportssame as before

Importsincrease

Thus, U.K will have a trade deficit at apegged exchange rate.

How to eliminate trade deficit?

The Bank of England could devalue theexchange rate from $2/pound to $1/pound.

This would make the U.S. goods become moreexpensive for the British.

So it should slow down the imports from theU.S. and improve trade balance again.

C. Puzzle: sometimes trade deficits become worsen after the devaluation

A devaluation of domestic currency

↓ price of domestic exports → export more

↑ price of foreign imports → import less

Trade deficit should improve.

However, it doesn’t always work like this in the real world. In many case, tradedeficits become worse after the devaluation.

Why?

ⅡElasticities Approach

A. Elasticities Approach to the Balance of Trade

1. The Elasticities Approach

The Elasticities Approach is concerned withhow change in relative prices of domestic and foreign goods will change thequantities traded.

2. Relative price

– the price of one good relative to another.

Relative prices change as relative demand andsupply for individual goods change (caused by changes in taste, productiontechnology, or government taxes/subsidies, etc.)

3. Exchange Rate and Relative Price

A change in the exchange rate could changethe price of foreign goods in terms of domestic currency.

4. Elasticities

When price falls:

A perfectly elastic demand, there is no change in the quantity.

An elastic demand (flat), larger increase in Q.

A inelastic demand (steep), smaller increase in Q.

5. Elasticity of Demand and Revenues

Total revenue= price x quantity

When the demand is elastic, an increase inprice will decrease the total revenue.

When the demand is inelastic, an increase inprice will increase the total revenue.

The devaluation and the J-curve

B. J-Curve

After the devaluation, it is often observedthat the trade balance initially deteriorates for a while before gettingimproved.

The pattern of the BOT after the devaluationcreates a J-curve.

1. Definition

J-curve effect – following a devaluation, trade balance is initially worsened beforeimproving later.

2. Why do we have a J-curve?

Two reasons to explain the downward part ofthe J-curve:

The currency contracting period

Immediately after the devaluation, trade andpayments contracts have already been negotiated prior to the change in exchangerate become revalued.

b. The pass-through period

After the devaluation, import prices andexport prices do not adjust as expected due to inelastic demand and/or supplycurves.

C. Currency Contract Period

Contracts are usually set up for 30, 60, and90 day payments and delivery.

Immediately after a devaluation, contractsnegotiated prior the exchange rate change become due

Contracts are signed at t1.

A currency devaluation at t2.

Payments have to be made at t3.

In this case, the buyers and sellers havelittle ability to respond to the devaluation (inelastic).

No change in quantity after the devaluation.

D. Pass-Through Analysis

The contracting explanation applied for theduration of the negotiation period (i.e. 30, 60, or 90 days). What happensafter that?

After the contract expires, the quantityadjustment might still be minimal, if the good is inelastic or if supplierscannot change the quantity supplied.

1. Definition

Pass-through analysis consider the elasticity of demand and supply resulting in an inabilityfor people to adjust in the short run.

What happens if:

Elasticity of demand for or supply of exports is inelastic.

Elasticity of demand for or supply of imports is inelastic.

2.Example: suppose that dollar devalues by 10%.

Case A: U.S. demandfor imports is perfectly inelastic.

A devaluation will increase the prices ofimports in dollar.

If imported goods are inelastic (e.g. hard tofind a close substitute of French wine), U.S. importers will continue to buy atQ1.

The supply curve shifts to the left. Foreignexporters want to charge a higher dollar price, because dollar is worth less.

American buyers pay 10% more.

Foreign exporters get the same in their currency.

Import values:

Original: P1 x Q1

New: P2 x Q1

Total import value ↑

Case B: Foreigners’demand for U.S. exports is perfectly inelastic.

After the devaluation, the supply curve (byU.S. exporters) shifts to the right.

U.S. exporters are willing to sell goods atlower price in foreign currency, because the foreign currency is now worthmore.

With the perfectly inelastic demand curve:

The U.S. exports the same quantity

American exporters charge lower price inforeign currency, but the value of exports in dollars remains the same.

Total export value constant.

Case C: supply offoreign production is inelastic.

The supply can be inelastic because theproductions are constrained by labor/resources contracts, such that plantscannot expand or decrease the amount produced.

Since dollar is weaken, foreign goods becomerelatively more expensive. The demandcurve shifts to the left.

The foreign currency price of imports fallsby the amount of devaluation.

Thus, there is no pass-through in this case(the price to foreigners does not change).

The value of imports in dollars constant.

Case D: Supply ofU.S. exports is perfectly inelastic

A weaken dollar would increase the demand forU.S. exports.

With the perfectly inelastic supply curve,the dollar price of exports rises by the full amount of the devaluation.

As the price in dollar increases, the valueof U.S. exports increases.

Total export value increases.

3. U.S. Trade Balance Effects DuringPass-Through Period (after the devaluation)

Box 4 is the case where the U.S. tradebalance get worsen, when both demands for U.S. imports and exports areperfectly inelastic.

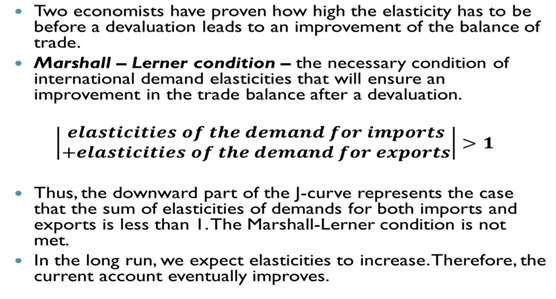

E. The Marshall-Lerner Condition

1. Marshall – Lerner Condition

2. Marshall-Lerner condition and the J-curve

MLC: If the sum of elasticities of demand forimports and demand for exports is greater than 1, then trade balance willimprove.

J-curve indicates that when devaluationincreases the price of foreign goods to the home country and decreases theprice of domestic goods to foreign buyers, there is a short-run period duringwhich trade balance falls.