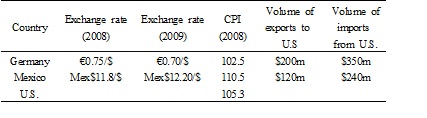

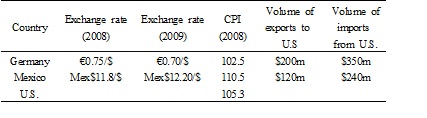

1. Use the informationpresented in table to answer the following questions.

1. What was the real exchange rate of the dollaragainst the euro in 2009?

2. What was the real exchange rate of the dollaragainst the peso in 2009?

3. Was the dollar appreciated or depreciatedagainst the euro in nominal term? By how many percent?

4. Was the Mexican peso appreciated ordepreciated against the dollar in nominal term? By how many percent?

5. What was the volume of the German foreign tradewith the U.S.?

6. What was the volume of the Mexican foreigntrade with the U.S.?

7. Assume the U.S. trades only with the Germanyand Mexico. Now if we want to calculate the dollar effective exchange rate in2009 against a basket of currencies of euro and Mexican peso, what should bethe weight assigned to the euro?

8. What should be the weight assigned to thepeso?

9. Assume the 2008 is the base year. What wasthe dollar effective exchange rate in 2009?

10. Was the dollar generally stronger or weakerin 2009 according to your calculation? Why?

ANS:

1. 0.70 x (105.3/102.5) = 0.7 x1.0273 = 0.7191

2. 12.2 x (105.3/110.5) = 12.2x .9529 = 11.6259

3. (0.7 /.75)–1 = -6.67% depreciated

(0.7 /.75)–1 = -6.67% 贬值

4. (1/12.2)/(1/11.8)–1 = -3.28% depreciated

(1/12.2)/(1/11.8)–1 = -3.28% 贬值

5. Trade with theGermany is(200 + 350) = 550

与德国的贸易额为(200 + 350) = 550

6. Trade with the Mexicois(120 + 240) =360

与墨西哥的贸易额为(120 + 240) =360

7. The weight assigned to the euro is 550/910 = 60.44%

分配给欧元的权重为 550/910 = 60.44%

8. The weight assigned to the peso is 360/910 = 39.56 %

分配给比索的权重为360/910= 39.56 %

9. Because the base year is 2008, the 2008 EER is 100. The value of the 2009 EER is: [(0.70/0.75)(60.44%)+ (12.2/11.8)(39.56%)] x 100 = (0.5641+0.4090) x 100 = 97.31

因为基年为2008年,2008年的有效汇率为100。2009年的有效汇率为:

[(0.70/0.75)(60.44%) +(12.2/11.8)(39.56%)] x 100 = (0.5641+0.4090) x 100 = 97.31

10. weaker, because97.31-100=-2.69, dollar depreciated by 2.69%.

变弱,因为97.31-100=-2.69,美元贬值2.69%。

2. Based on the informationpresented below:

Current price of abarrel of crude oil (BCL) in the US: $105

Current price ofBCL in Mexico: MXN 1,480

Current exchangerate: 1 USD = MXN 12.70

applying the Big Mac type analysis to determine thefollowing:

a) The price of BCL in Mexico in terms of US dollars(based on the going exchange rate)

b) What should the exchange rate be for the Mexican pesosso that the price of BCL is the same in both countries?

c) Based on the current price of BCL in both countries,what is the percentage overvaluation or undervaluation of the Mexican pesoagainst the USD?

d) Suppose the price of BCL increased by 17% in the USand 11% in Mexico. At the end of the year the exchange rate is MXN 12.25 perUSD. Which currency appreciated in “real terms” USD or MXN?

Solutions

a) The price of BCL in Mexico in terms of US dollars(based on the going exchange rate)

1480 / 12.70 = $116.54

b) What should the exchange rate be for the Mexican pesosso that the price of BCL is the same in both countries?

1480 / 105 = MXN 14.095 = I USD

c) Based on the current price of BCL in both countries,what is the percentage overvaluation or undervaluation of the Mexican pesoagainst the USD?

(14.095 – 12.70) / 12.70 = 10.986% overvaluation of MXNagainst the USD

d) Suppose the price of BCL increased by 17% in the USand 11% in Mexico. At the end of the year the exchange rate is MXN 12.25 perUSD. Which currency appreciated in “real terms” USD or MXN?

According to PPP, the expected percentage change in the exchange rate for USD is

πMEXICO -πUS =11%-17%=-6%

The actual percentage change in the exchange rate is

%△SMXN/USD=(12.25-12.7) / 12.7= -3.54%

So in “real terms”USD appreciated.

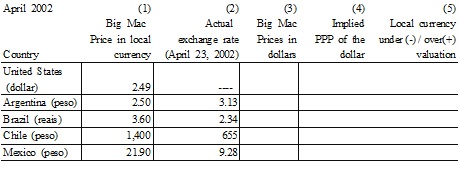

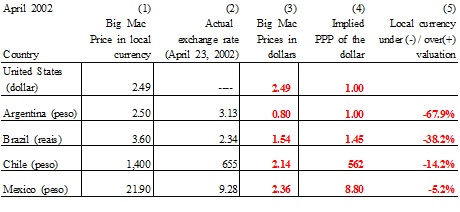

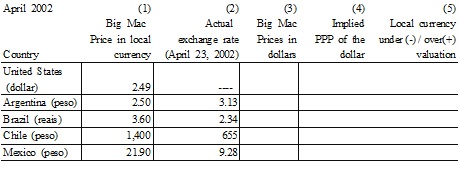

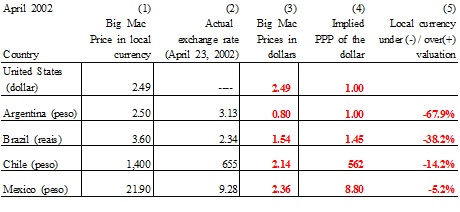

3. Below are the Big Mac prices and actualexchange rates for select Latin American countries as printed in previouseditions. Use the data to complete the calculation of the implied PPP value ofthe currency versus the U.S. dollar and the calculation as to whether thatcurrency is undervalued (-%) or overvalued (+%) versus the U.S. dollar.

Solution:

4. In January 2000, the spot exchange rate for theeuro was 1.05$/euro. In September 2009 that rate was 1.43$/euro. In January2000, the euro area CPI was 107.5, and the US CPI was 112.7. In September 2009,the euro are CPI was 120 and the US CPI was 125. Based on this information,answer the following questions:

a) Innominal terms, did the euro appreciate or depreciate against the dollar? Whatwas the rate of appreciation / depreciation?

b) Usingthe information on question a), calculate the real exchange rate for the euroin January 2000 and September 2009.

c) Inreal terms, did the euro appreciate or depreciate against the dollar? What wasthe rate of appreciation / depreciation?

d) Accordingto absolute purchasing power parity (PPP), was the euro undervalued or overvaluedrelative to the dollar in September 2009? By what percent?

e) Accordingto relative PPP, what is the predicted value for the euro for September 2009?Was the euro over or undervalued relative to the dollar in September 2009? By whatpercent?

ANS:

a) Therate of nominal depreciation (appreciation) of the dollar (euro) was: (1.43−1.05)/ 1.05 ×100 = 36.19%

b) RER2000 = 1.05 × 107.5/112.7 = 1.0015

RER2009= 1.43 × 120/125= 1.3728

c) Theeuro also appreciated in real terms by 37%.

d) S = Pd/Pf=125/120 = 1.0416 The euro is overvalued because the impliedrate is below the market rate. 37.5% rate of overvaluation.

e)%△S =%△Pd − %△Pf= 10.91%-11.62%=- 0.71% So, with S in 2000 equal to 1.05, S in 2009should have equaled 1.042525 according to relative PPP. Thus, the euro seems tohave been overvalued, with an overvaluation rate of 37.16%.