-

1 基本概念

-

2 PPT

-

3 可汗公开课

-

4 视频小课堂

-

5 自我测试

Chapter 6 Exchange Rates, Interest Rates, and Interest Parity

ⅠForward rateand interest rate

In this chapter, we will study therelationship between interest rates and exchange rates.

How exchange rates adjust to bringequilibrium in financial markets.

A. Explaining interest rate

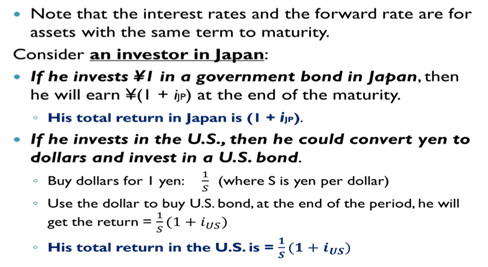

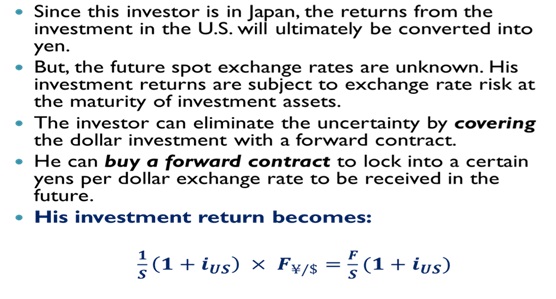

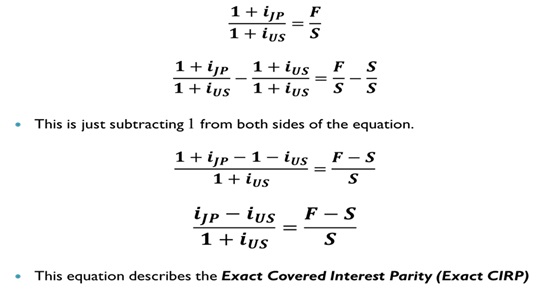

B. Deriving the Exact Covered Interest Parity Condition

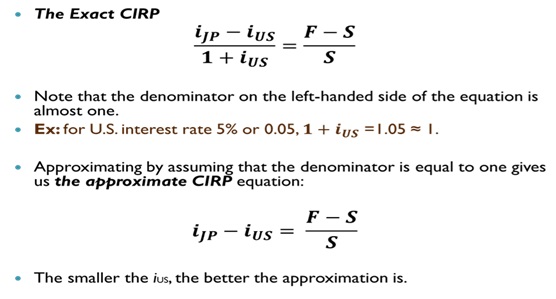

C. Exact CIRP vs. Approximate CIRP

Ⅱ Interest rate parity

A. Definition

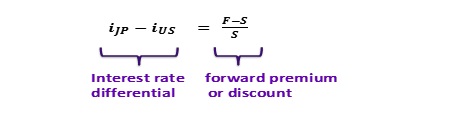

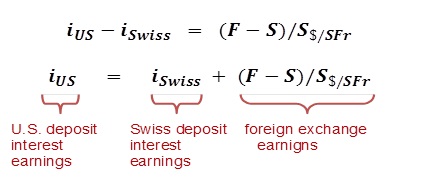

Interest rate parity – the interest differential between a comparable investment in twocountries equal to the forward premium or discount.

Interest rates reflects what is going tohappen in exchange rates.

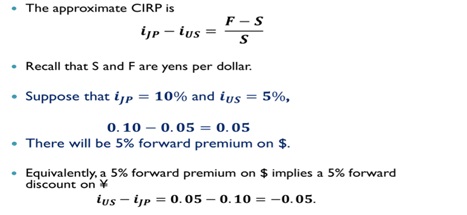

Ex: if interest rate is lower in the U.S.than in Japan, we would expect a forward premium on dollar.

Forward premium – when F > S

Forward discount – when F < S

The foreign exchange market ties interestrates across countries.

iJP > iUS→ (+) interest differential → (+) expected change in the value of dollar(expect dollar to appreciate)

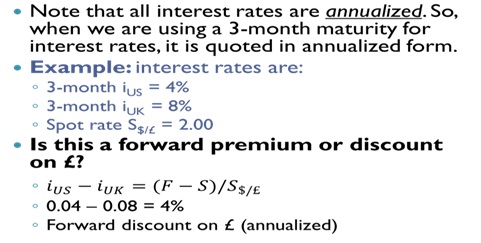

B. Example: Using the CIRP

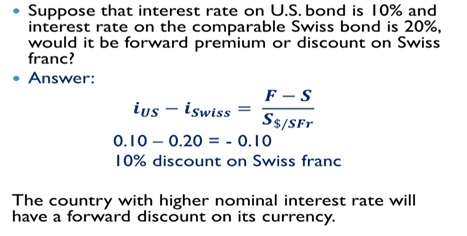

C. Another Example

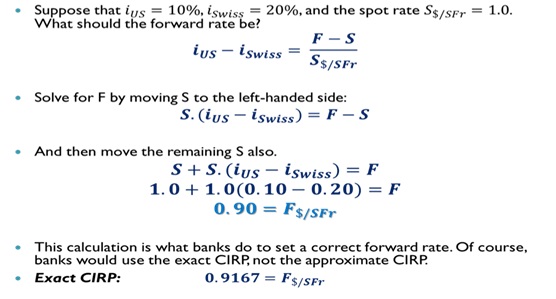

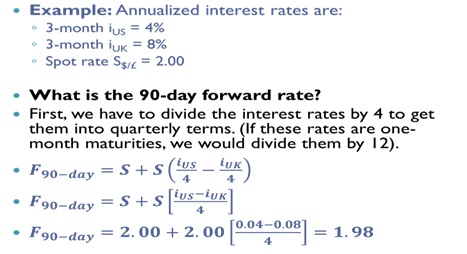

D. Deriving the forward rate

E. What if the bank sets forward rate incorrectly?

iUS = 10%, iSwiss =20%, and spot rate = 1.0.

The correct forward rate = 0.90.

10% = 20% + (-10%)

Suppose an intern sets the rate at 1.00.

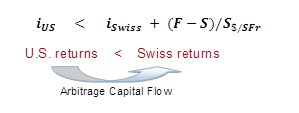

At Fbad = 1.00, then 10% < 20%+ (0%)

The Swiss return exceeds the U.S. return,causing capital flow into Switzerland.

F. Arbitrage Opportunity

With Fbad = 1.00, the returns onSwiss deposit is greater than the U.S deposit.

You could buy SFr at the spot rate and theninvest and sell SFr forward for dollars, because the future price of SFr ishigher than the implied rate by interest parity condition.

These actions would:

Increase spot rate

Decrease forward rate

Increase U.S. interest rate

Decrease Swiss interest rate

Until we are back at the equilibriumagain. Arbitrage will cause the CIRP tohold.

G. Example: Deriving 3-month forward rates

H. How well does CIRP hold?

1. CIRP is an arbitrage condition, so itholds very well.

Arbitrageurs will make sure that thecondition holds. When they see anarbitrage profit opportunity, they will react quickly to benefit from it,automatically closing the arbitrage opportunity.

2. Why CIRP may not hold exactly?

Transaction costs

Tax treatment of investment (capital gain tax on foreign earnings, butincome tax on interest earnings)

Political risk (default risk of foreign government and risk of capitalcontrols)

Non-comparable asset (Ex: U.S. 1 year = 360 days, while U.K. 1 year =361days. Their returns would be slightly different.)