-

1 基本概念

-

2 PPT

-

3 视频小课堂

-

4 自我测试

Chapter 7 Prices and Exchange Rates: Purchasing Power Parity

Ⅰ The Law of One Price

A. Connection between prices of goods andexchange rate

In the last chapter, we discussed the CIRP,which connects the interest returns on comparable assets in two counties andtheir exchange rate.

One can view financial assets as commoditiesthat are easily traded, well-defined and have few restrictions to trade.

In general, a similar connection also existsbetween prices of regular commodities and exchange rates.

B. Should an identical good be sold at thesame price everywhere?

Suppose the price of 1 pint of beer at one pub is $5, while the price ofthe same beer at a similar pub across the street is $12.

What do you predict to happen?

Many people would buy the $5 beer, few wouldbuy the $12.

Due to the increased demand, the price of the $5 beer would tend toincrease.

Due to the decreased demand, the price of the $12 beer would tend todecrease.

At the end the price of beer from both placeswill be the same.

Now imagine that the two pubs are located in two different countries:one pub is in Seattle and the other is in Vancouver(温哥华).

Should the price of beer be the same? Why orWhy not?

C.Law of One Price (LOP)

Law of One Price – in the absence of transaction costs and official trade barriers, identical goods will have the same price indifferent markets when the prices are expressed in the same currency.

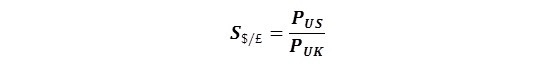

PUS = S$/£*PUK

Ⅱ Absolute Purchasing Power Parity

A. What is Purchasing Power Parity (PPP)?

PPP – explains therelationship between the prices of goods and services and exchange rates.

PPP captures the connection between goodsmarket and foreign exchange market.

How much money would be needed to purchase the same goods and servicesin two countries.

B. Absolute Purchasing Power Parity

Absolute PPP – the exchange rate between two currencies is equal to the ratio oftheir price indexes.

This concept is an extension from the LOP bygeneralizing the price of a particular good to an overall price level in thecountry.