-

1 基本概念

-

2 PPT

-

3 自我测试

ⅣThe term structure of interest rates

A. The term structure of interest rates

Term structure of interest rates – the structure of interest rates existingon investment opportunities over time.

Ex: interest rates for 3-month, 6-month,1-year, 3-year, 30-year assets.

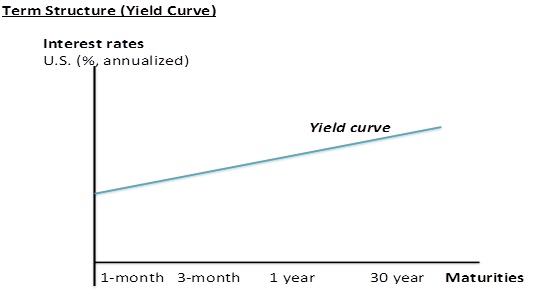

If the interest rate rise with the term tomaturity, then we observe a rising term structure (a positive sloping yieldcurve).

If the interest rates are the same at everymaturity, the term structure will be flat (the yield curve will be a horizontalline).

B. Upward Sloping Yield Curves

Bonds with identical risk, liquidity, and taxcharacteristics may have different interest rates because the time remaining tomaturity is different.

A yield curve – a plot of the returns on bonds with different terms to maturity buthaving the same risk, liquidity, and tax considerations.

A yield curve describes the term structure ofinterest rates for particular types of bands, such as government bonds.

When the yield curves slope upward, theinterest rates on longer-term bonds are higher than the short-term bonds.

If the yield curves are inverted, thelong-term interest rates are below the short-term interest rates.

If the yield curve is flat, the short- andlong-term interest rates are the same.

C. Why are yield curves upward sloping?

1. Segmented market theory of term structure

Markets for different-maturity bonds are seenas completely separate and segmented.

Bonds of different maturities are notsubstitutes, so the return on a bond of one maturity has no effect on thedemand for a bond of another maturity.

In a typical situation, the demand forlong-term bonds is relatively lower than that for short-term bonds. So, thelong-term bonds will have lower price and higher interest rate. Hence, theyield curve will slope upward.

2. Liquidity Premium Theory

The interest rate on long-term bond willequal an average of short-term interest rates expected to occur over the lifeof the long-term bond plus a liquidity premium.

Bonds of different maturities aresubstitutable, but not perfect substitutes.

Investors tend to prefer short-term bondsbecause these bond bear less interest-rate risk.

For this reason, investors must be offered apositive liquidity premium to induce them to hold longer-term bonds.

Hence, the yield curve is upward sloping.

3. Preferred habitat theory

Investors have a preference for bonds of onematurity over another, a particular bond maturity (preferred habitat) in whichthey prefer to invest.

Because investors are likely to prefer thehabitat of short-term bonds over that of longer-term bonds, they are willing tohold longer-term bond only if they have higher expected returns.

ⅤThe term structure and exchange rate

A. Using the yield curves to determine if acurrency has a forward premium or discount

When one country has higher interest ratethan another, the high-interest-rate currency is expected to depreciate (aforward discount in that currency).

Thus, differences between term structure ofinterest rates in two countries will reflect expected change in exchange rate.

We can use the yield curves of differentcountries to determine whether a country has a premium or discount on itscurrency at any given point in time as well as across the term structure.

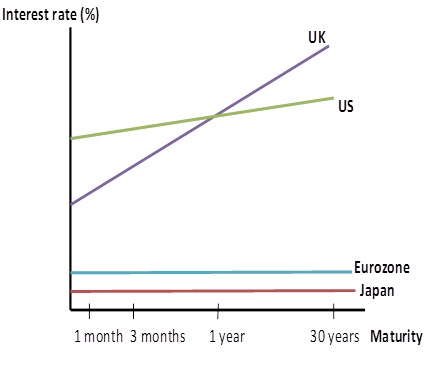

B. Example: Suppose these countries have aterm structure of interest rates as plotted in the following figure:

Question1: Is there a premium or discount on the U.S. dollar in terms ofJapanese yen at 1 month maturity?

Because the U.S. interest rate exceeds theJapanese interest rate, the dollar sells at a forward discount at the 1 monthmaturity.

Question2: What happens to the dollar at higher maturity?

Because the U.S. has a positive yield curveand Japan has a flat yield curve, the difference becomes larger for each periodof maturity. The forward discount on dollar becomes larger across time.