-

1 基本概念

-

2 PPT

-

3 自我测试

Ⅳ Relative Purchasing Power Parity

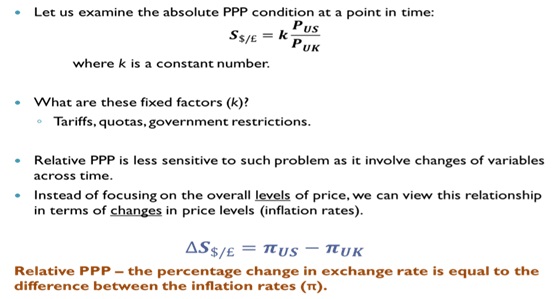

Absolute PPP – the exchange rate equals to the ratio of price levels between twocountries.

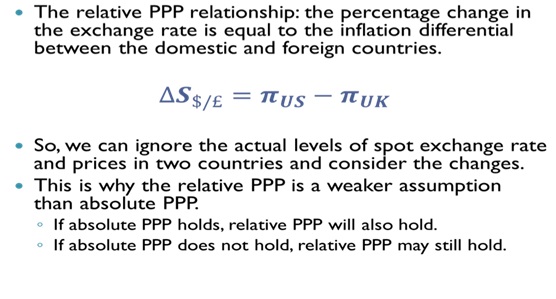

Relative PPP – the percentage change in the exchange rate equal to the inflationdifferential between two countries.

Relative PPP is a weaker condition than theabsolute PPP.

It holds better in the short run thanabsolute PPP.

A. From Absolute PPP to Relative PPP

B. Relative PPP

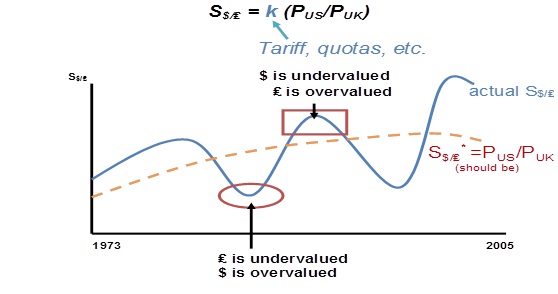

C. Deviations from PPP

It seems that there are many currencies withlarge over- or under-valuations from implied PPP exchange rates.

Questions:

Does PPP not hold?

Are these countries manipulating their currencies?

Is there anything wrong about using Big Mac as a benchmark commodity fortesting PPP?

Does Absolute PPP hold?

Sometimes. We see substantial deviations from PPP.

Reasons:

Differentiated products (not comparable between countries)

Transaction costs (information and transportation costs are differentacross countries)

Trade barriers (ex. tariff, quota, etc.)

Some goods are not tradable across borders (so low arbitrage activities)such as services.

Local regulations and taxes

Consumer preferences differ in different countries.

The PPP equilibrium seldom exists

The general PPP concept is not as likely tohold perfectly as the LOP.