7.3 Overvalued and Undervalued Currencies

-

1 基本概念

-

2 PPT

-

3 视频小课堂

-

4 自我测试

-

5 Case Study

上一节

下一节

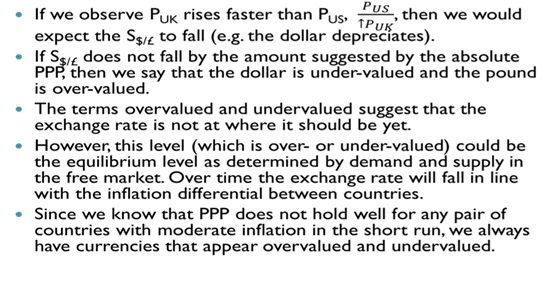

D. Overvalued and Undervalued

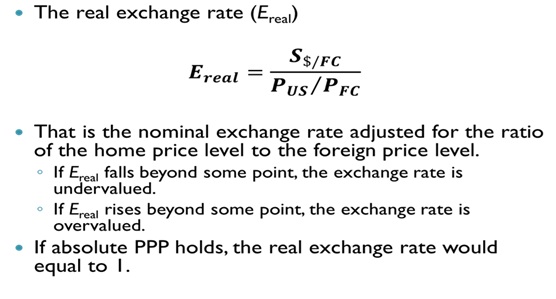

Ⅴ Real exchange rate

A. Definitions

Nominal exchange rate – the exchange rate that is actually observed in the foreign exchangemarket.

Real exchange rate – the nominal exchange rate after adjusting for inflation differentialbetween countries.

Real exchange rate is used as an indicatorfor competitiveness of international trade of a currency.

It is an alternative way to think aboutcurrencies being over- or undervalued.

B. Real Exchange Rate

The percentage change in real exchange rate (% △Ereal):

%△Ereal=%△Sd/f+%△Pf-%△Pd