-

1 problems

-

2 answers

1. Based on the informationpresented below:

Current price of a barrel of crude oil (BCL) in the US: $105

Current price of BCL in Mexico: MXN 1,480

Current exchange rate: 1 USD = MXN 12.70

applying the Big Mac type analysis to determine the following:

a) The price of BCL in Mexico in terms of US dollars(based on the going exchange rate)

b) What should the exchange rate be for the Mexican pesos so that the price of BCL is the same in both countries?

c) Based on the current price of BCL in both countries, what is the percentage overvaluation or undervaluation of the Mexican peso against the USD?

d) Suppose the price of BCL increased by 17% in the US and 11% in Mexico. At the end of the year the exchange rate is MXN 12.25 per USD. Which currency appreciated in “real terms” USD or MXN?

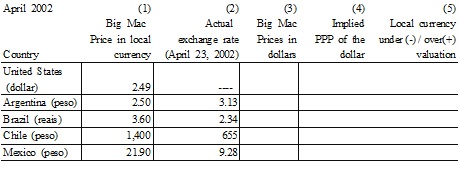

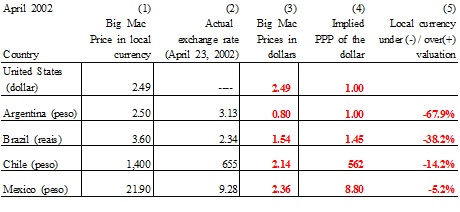

2. Below are the Big Mac prices and actual exchange rates for select Latin American countries as printed in previous editions. Use the data to complete the calculation of the implied PPP value of the currency versus the U.S. dollar and the calculation as to whether that currency is undervalued (-%) or overvalued (+%) versus the U.S. dollar.