-

1 基本概念

-

2 PPT

-

3 自我测试

Ⅲ Foreign Exchange Futures Market

A. Definitions

1. Futures market is similar to the forward market where currencies may be bought andsold for future delivery.

2. Futures – an agreement to buy or sell a standard quantity of a specific foreigncurrency at a specified future date and at a price agreed on an exchange.

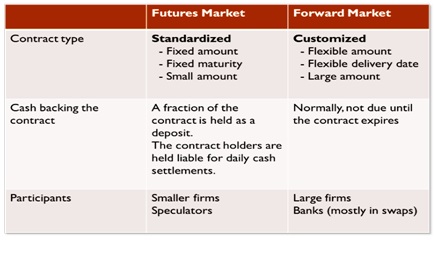

B. Forward vs. Futures

C. How currency futures work?

Chicago Mercantile Exchange (CME) is thelargest currency futures market.

The futures market differs from the forwardmarket in that only a few currencies are traded.

The contracts involve a specific amount of currency to be delivered at specific maturitydates.

Contracts mature on the third Wednesday ofMarch, June, September, and December.

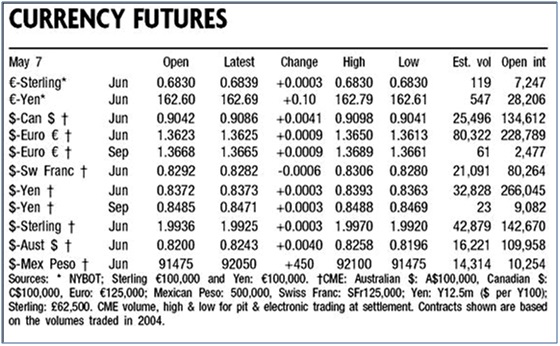

D. How to read the table?

1. Example:Swiss Franc

The contractis written for a fixed amount of 125,000 SFr.

Numbers are indollars per Swiss Franc

Month – month that the contract matures(June)

Open – the price that contract had at thebeginning of the trading day

Latest – the settlement price or the closingprice on that day.

High/ Low – the highest (lowest) tradingprice on that day.

Change – a change in the price from previoustrading day.

Est. vol – the estimated number of contractsactually exchanged during that day.

Open Int – the number of contractsoutstanding (open interest).

2. Example ofSwiss Franc Purchase

For a 125,000 Swiss Franc future for Junethat we purchase on May 7th.

May 7th: 125,000 x 0.8282 = $103,525 (using the settle price at the end of theday).

To buy the 125,000 SFr, you need to pay$103,525 when the contract matures in June.

The amount that will cost you in June isalready fixed on May 7th.

Since you are not going to pay the money forawhile, the bank typically wants a small portion of the cost as security(margin), depending on how reliable you are as a trader. Let say, the bank need10% to secure the deal. You will have to put $10,352.50 in a saving accountwith the bank.

E. How do we benefit or lose from thisfutures contract?

May 7th: 125,000x 0.8282 = $103,525

What would happens if the exchange ratechanges?

On May 14th, if $/SFr = 0.9000 (SFrappreciates):

May 14th: 125,000 x 0.9000 = $112,500

We have made $8,975 in a week, if we sell.

However, we can also lose.

On May 21st, if $/SFr = 0.8000 (SFrdepreciates):

May 21st: 125,000 x 0.8000 = $100,000

Now you are losing money on your position-$3,525.

You should have sold your position last weekto realize the gain that you had then. The bank may ask you to deposit moremoney (margin call), if you continue to hold the position as you are losingmoney.