-

1 基本概念

-

2 PPT

-

3 视频小课堂

-

4 自我测试

Ⅳ Options

Options – are contractsthat give a buyer the option, or right, to buy or sell the underlying financialinstrument at a specified price within a specific period.

A specified price is called exercise price orstrike price.

The seller of the option is obligated to buyor sell the financial instrument to the buyer if the owner of the optionexercises the right to buy or sell.

The owner (or buyer) of an option does nothave to exercise the option. She can let the option expire without using it.

The owner of an option will have to pay apremium for the right to buy or sell the currency at a fixed price.

A. Options: some definitions

American options – can be exercised at any time up to the expiration date of thecontract.

European options – can be exercised only on the expiration date.

Foreign currency option – is a contract that provides the right tobuy or sell a given amount of currency at a fixed exchange rate on or beforethe maturity date.

A calloption – a contract that gives the owner the right to buy.

A putoption – a contract that gives the owner the right to sell.

Strike price – price you have the option to buying or selling.

B. Example: Options

Suppose you need to deliver pound (£) in thefuture at a price $1.50 per pound.

If £ appreciates, you will lose money. Thus,you want to hedge against the exchange rate risk.

You could buy £ in the forward market, butthis means that you are obligated to buy £. What if the price of £ is low inthe future?

To retain some flexibility, you can buy anoption.

In this case, it is an option to buy Britishpound (call option).

Options are rights, rather than obligations,to buy or sell. So, your payoff depends on whether you exercise the options ornot.

1. How do the call options work?

For the call option:

If S > K, you are “in-the-money” and youcan make a profit. Your payoff is the difference between the current price andthe strike price, less the cost of the option.

If S < K → the option would not be exercised. Yourpayoff will be zero and you lose only the premium paid for the option.

S = current price or the spot exchange rate

K = the strike price (the price you lock into buy currency in the future).

The payoff from a call option is:

Not Exercise | Choose to Exercise | |

Call Option | 0 | S - K |

2. How do the put options work?

For the put option:

If S > K, the option will not beexercised. You can make more by selling in the spot market. Thus, the payoff iszero. You only lose the option premium.

If S < K, a fall in the spot price makesthe put option more profitable. Your profit is the difference between thestrike price and the current price of currency. You are “in-the-money.”

S = current price or the spot exchange rate

K = the strike price (the price you lock into sell currency in the future).

The payoff from a put option is:

Not Exercise | Choose to Exercise | |

Put Option | 0 | K - S |

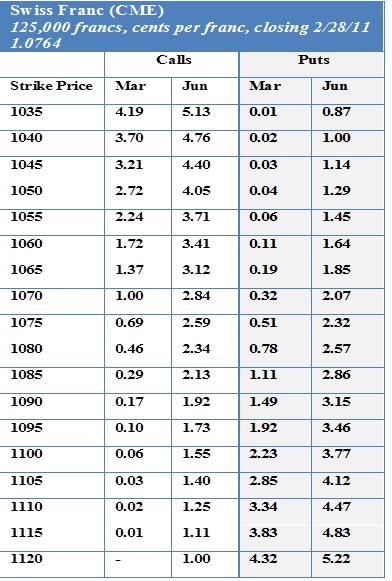

The option prices for 125,000 Swiss Franccontract

Contracts were quoted on Feb. 28, 2011. Onthat day the spot Swiss franc values was $1.0764.

2 types of contracts: call and put options.

2 maturities: March and June.

Each strike price has a cost in terms ofcents per SFr for a call or put option.

Ex: at a 1045 strike price, the price of acall option for June is 4.40 cents per Swiss franc. This contract will give youa right to buy Swiss Franc in June at $1.045 per SFr.

Suppose that you need 1 million Swiss Francin June.

You need 8 contracts of 125,000 SFr.

Suppose that you choose 1090 as a strikeprice (giving you the right to buy/sell SFr at $1.090).

You will buy the call options – cost 1.92cents per SFr.

The cost of buying 8 contracts of the calloptions:

1.92/100x 125,000 x 8 = $19,200

In June:

If the SFr appreciates to $1.20 – youexercise the option and buy SFr at $1.09.

If the SFr depreciates to $1.00 – you throwthe options away and buy SFr in the spot market (lose $19,200).

Ⅴ Recent Practices

The growth of options contracts since theearly 1980s has stimulated the development of new products and techniques form anaging foreign exchange assets and liabilities.

One recent development combines the featuresof a forward contract and an option contract.

Break forward, participating forward, or FOX(forward with option exit) refer to forward contracts with an option to break out of the contract at a future date.

Scout (share currency option under tender) as an option that is sold to the contract awarder, who then sells it to the successful bidder.